Table of Contents

ToggleIntroduction

Tax planning and preparation are essential components of financial management for residents of Sherwood Park. Proper tax planning can help you minimize your tax liability, ensure compliance with tax laws, and make informed financial decisions. In this article, we will provide comprehensive tax planning and preparation tips tailored to Sherwood Park residents. Whether you are an individual taxpayer, a business owner, or a retiree, these tips will help you navigate the complexities of the Canadian tax system and achieve your financial goals.

Understanding the importance of tax planning and preparation is crucial for effective financial management. Many taxpayers only think about taxes during the filing season, but year-round tax planning can lead to significant benefits. By taking a proactive approach, you can identify opportunities for tax savings, avoid potential pitfalls, and ensure that you are well-prepared for tax time.

In addition to minimizing tax liability, proper tax planning can also help you achieve other financial goals, such as saving for retirement, funding education, or managing debt. By aligning your tax strategy with your overall financial plan, you can make more informed decisions and optimize your financial outcomes.

The role of professional tax advisors, such as BOMCAS, in supporting Sherwood Park residents cannot be overstated. Our team of experts is dedicated to providing personalized tax planning and preparation services, ensuring that you receive the guidance and support you need to navigate the complexities of the tax system. We offer comprehensive services, from tax return preparation to strategic tax planning, to help you achieve your financial goals.

In the sections that follow, we will delve deeper into the specifics of tax planning and preparation, providing practical tips and advice for Sherwood Park residents. Whether you are looking to maximize deductions, plan for retirement, or navigate the tax implications of life changes, this guide aims to provide you with valuable insights and actionable strategies.

Understanding Tax Planning

What is Tax Planning?

Tax planning is the process of organizing your financial affairs in a way that minimizes your tax liability while ensuring compliance with tax laws. It involves analyzing your financial situation, identifying opportunities for tax savings, and implementing strategies to achieve those savings. Tax planning is an ongoing process that should be integrated into your overall financial plan.

Effective tax planning involves understanding the various components of the tax system, including income taxes, deductions, credits, and tax brackets. By staying informed about current tax laws and regulations, you can make informed decisions that align with your financial goals and minimize your tax liability.

One of the key principles of tax planning is to take advantage of all available tax deductions and credits. Deductions reduce your taxable income, while credits reduce your tax liability directly. By maximizing these benefits, you can lower your overall tax burden and increase your financial savings.

Tax planning also involves timing your income and expenses strategically. For example, deferring income to a future year or accelerating deductions into the current year can help you take advantage of lower tax rates and minimize your tax liability. Understanding the timing of your financial transactions is essential for effective tax planning.

In addition to minimizing tax liability, tax planning can also help you achieve other financial goals, such as saving for retirement, funding education, or managing debt. By aligning your tax strategy with your overall financial plan, you can make more informed decisions and optimize your financial outcomes.

Professional tax advisors, such as BOMCAS, can provide valuable assistance in developing and implementing a tax planning strategy. Our team of experts can help you understand the complexities of the tax system, identify opportunities for tax savings, and ensure compliance with tax laws. With our guidance, you can achieve your financial goals and enjoy greater peace of mind.

Importance of Year-Round Tax Planning

Many taxpayers only think about taxes during the filing season, but year-round tax planning can lead to significant benefits. By taking a proactive approach to tax planning, you can identify opportunities for tax savings, avoid potential pitfalls, and ensure that you are well-prepared for tax time.

Year-round tax planning involves regularly reviewing your financial situation, monitoring changes in tax laws, and adjusting your strategies as needed. This ongoing process allows you to stay informed about your tax obligations and make informed decisions that align with your financial goals.

One of the key benefits of year-round tax planning is the ability to take advantage of opportunities for tax savings as they arise. For example, changes in tax laws or your financial situation may present new opportunities for deductions, credits, or other tax benefits. By staying informed and proactive, you can capitalize on these opportunities and minimize your tax liability.

Year-round tax planning also helps you avoid potential pitfalls, such as underpayment penalties, missed deadlines, or non-compliance with tax laws. By staying organized and prepared, you can ensure that you meet all your tax obligations and avoid costly mistakes.

Another important aspect of year-round tax planning is the ability to plan for life changes that may impact your taxes. Life events such as marriage, divorce, the birth of a child, or a change in employment can have significant tax implications. By planning ahead, you can ensure that you are prepared for these changes and make informed decisions that optimize your financial outcomes.

Professional tax advisors, such as BOMCAS, can provide valuable assistance in year-round tax planning. Our team of experts can help you stay informed about changes in tax laws, identify opportunities for tax savings, and develop strategies to achieve your financial goals. With our guidance, you can enjoy greater peace of mind and confidence in your financial planning.

Key Components of Tax Planning

Effective tax planning involves understanding and optimizing various components of the tax system. Here are some key components of tax planning for Sherwood Park residents:

- Income Taxes: Understanding how income taxes are calculated and how different types of income are taxed is essential for effective tax planning. This includes wages, salaries, self-employment income, investment income, and other sources of income. By understanding the tax treatment of your income, you can develop strategies to minimize your tax liability.

- Deductions: Tax deductions reduce your taxable income, which in turn reduces your tax liability. Common deductions include expenses related to employment, business expenses, medical expenses, charitable donations, and education expenses. By maximizing your deductions, you can lower your overall tax burden.

- Credits: Tax credits reduce your tax liability directly and can provide significant savings. Common credits include the Canada Child Benefit, the GST/HST credit, the Working Income Tax Benefit, and education credits. By taking advantage of available credits, you can further reduce your tax liability.

- Tax Brackets: Understanding how tax brackets work is crucial for effective tax planning. Canada uses a progressive tax system, which means that different portions of your income are taxed at different rates. By managing your income and deductions strategically, you can minimize the impact of higher tax brackets and lower your overall tax liability.

- Timing of Income and Expenses: Timing your income and expenses strategically can help you take advantage of lower tax rates and minimize your tax liability. For example, deferring income to a future year or accelerating deductions into the current year can result in significant tax savings. Understanding the timing of your financial transactions is essential for effective tax planning.

- Retirement Planning: Planning for retirement involves understanding the tax implications of different retirement savings options, such as RRSPs and TFSAs. By contributing to these accounts strategically, you can reduce your current tax liability and ensure a secure financial future.

Professional tax advisors, such as BOMCAS, can provide valuable assistance in understanding and optimizing these components of tax planning. Our team of experts can help you develop a comprehensive tax planning strategy that aligns with your financial goals and minimizes your tax liability.

Maximizing Deductions and Credits

Common Tax Deductions for Sherwood Park Residents

Tax deductions reduce your taxable income, which in turn reduces your tax liability. Here are some common tax deductions available to Sherwood Park residents:

- Employment Expenses: If you incur expenses related to your employment, such as travel, tools, or supplies, you may be eligible to deduct these expenses from your taxable income. To qualify, you must have a signed Form T2200 from your employer.

- Business Expenses: Self-employed individuals and business owners can deduct various business-related expenses, such as office supplies, advertising, travel, and equipment. Proper documentation and record-keeping are essential for claiming these deductions.

- Medical Expenses: Medical expenses that exceed a certain threshold can be deducted from your taxable income. Eligible expenses include prescription medications, dental care, and medical devices. Keep detailed records of your medical expenses to support your deduction claims.

- Charitable Donations: Donations to registered charities are eligible for a tax credit. Keep receipts for all charitable donations and ensure that the charity is registered with the Canada Revenue Agency (CRA).

- Education Expenses: Tuition fees, textbooks, and other education-related expenses may be eligible for a tax credit. The Canada Training Credit and the Tuition Tax Credit are common education-related credits available to students.

- Home Office Expenses: If you work from home, you may be eligible to deduct a portion of your home office expenses, such as utilities, rent, and internet. To qualify, you must use a designated area of your home exclusively for work and meet certain criteria set by the CRA.

By maximizing these deductions, Sherwood Park residents can lower their overall tax burden and increase their financial savings. Professional tax advisors, such as BOMCAS, can provide valuable assistance in identifying and claiming eligible deductions.

Key Tax Credits for Sherwood Park Residents

Tax credits reduce your tax liability directly and can provide significant savings. Here are some key tax credits available to Sherwood Park residents:

- Canada Child Benefit (CCB): The CCB is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18. The amount of the benefit is based on family income, the number of children, and the age of the children.

- GST/HST Credit: The GST/HST credit is a tax-free quarterly payment that helps individuals and families with low to modest incomes offset the cost of GST/HST. The amount of the credit is based on family income and the number of eligible children.

- Working Income Tax Benefit (WITB): The WITB is a refundable tax credit that provides financial support to low-income working individuals and families. The amount of the benefit is based on earned income and family size.

- Education Credits: Students may be eligible for various education-related credits, such as the Tuition Tax Credit and the Canada Training Credit. These credits help offset the cost of tuition fees, textbooks, and other education-related expenses.

- Home Accessibility Tax Credit (HATC): The HATC is a non-refundable tax credit for eligible home renovation expenses that improve accessibility or safety for individuals with disabilities. Eligible expenses include ramps, stair lifts, and handrails.

- Disability Tax Credit (DTC): The DTC is a non-refundable tax credit that provides financial relief to individuals with disabilities or their supporting family members. To qualify, you must have a severe and prolonged impairment in physical or mental functions.

By taking advantage of these credits, Sherwood Park residents can further reduce their tax liability and increase their financial savings. Professional tax advisors, such as BOMCAS, can provide valuable assistance in identifying and claiming eligible credits.

Record-Keeping and Documentation

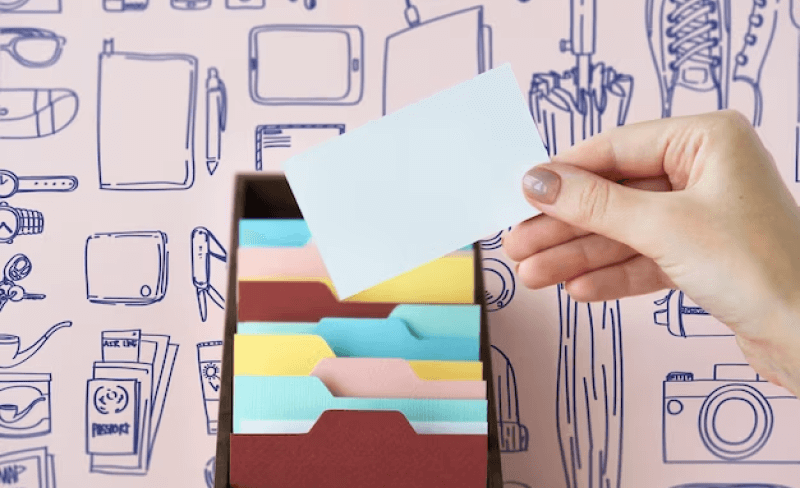

Proper record-keeping and documentation are essential for claiming tax deductions and credits. Here are some tips for effective record-keeping:

- Keep Detailed Records: Maintain detailed records of all income, expenses, and financial transactions. This includes receipts, invoices, bank statements, and other supporting documentation. Proper documentation is essential for substantiating your deduction and credit claims.

- Organize by Category: Organize your records by category, such as employment expenses, business expenses, medical expenses, and charitable donations. This makes it easier to locate specific records and ensure that you have all necessary documentation for your claims.

- Retain Records for Several Years: The CRA requires taxpayers to retain their records for a minimum of six years from the end of the tax year to which they relate. Ensure that you keep your records for the required period to comply with CRA regulations.

- Use Digital Tools: Consider using digital tools and software to manage your records and documentation. Digital tools can help you organize and store your records securely, making it easier to access and retrieve them when needed.

- Regularly Review and Update Records: Regularly review and update your records to ensure that they are complete and accurate. This includes reconciling your records with your bank statements and financial reports.

- Seek Professional Assistance: Professional tax advisors, such as BOMCAS, can provide valuable assistance in record-keeping and documentation. Our team can help you organize your records, identify any gaps or discrepancies, and ensure that you have the necessary documentation to support your deduction and credit claims.

Proper record-keeping and documentation are essential for maximizing your tax deductions and credits and ensuring compliance with tax laws. By following these tips, Sherwood Park residents can maintain accurate and complete records and enjoy greater peace of mind during tax time.

Strategic Tax Planning for Retirement

Importance of Retirement Planning

Planning for retirement is an essential component of financial management. Proper retirement planning involves understanding the tax implications of different retirement savings options and developing strategies to achieve a secure financial future.

Retirement planning is important for several reasons:

- Financial Security: Proper retirement planning ensures that you have sufficient financial resources to maintain your standard of living during retirement. This includes covering essential expenses, such as housing, healthcare, and daily living costs.

- Tax Efficiency: Retirement planning allows you to take advantage of tax-efficient savings options, such as Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs). By contributing to these accounts strategically, you can reduce your current tax liability and maximize your retirement savings.

- Goal Achievement: Retirement planning helps you achieve your long-term financial goals, such as traveling, pursuing hobbies, or supporting family members. By planning ahead, you can ensure that you have the financial resources to achieve these goals.

- Peace of Mind: Proper retirement planning provides peace of mind and confidence in your financial future. By taking a proactive approach, you can avoid potential financial challenges and enjoy a more secure and comfortable retirement.

- Legacy Planning: Retirement planning also involves considering your legacy and how you want to pass on your wealth to future generations. This includes estate planning, charitable giving, and other strategies to leave a lasting impact.

Professional tax advisors, such as BOMCAS, can provide valuable assistance in retirement planning. Our team can help you understand the tax implications of different retirement savings options, develop a comprehensive retirement plan, and ensure that you achieve your financial goals.

Maximizing RRSP Contributions

Registered Retirement Savings Plans (RRSPs) are a popular retirement savings option in Canada. Contributions to an RRSP are tax-deductible, and the investment income earned within the account is tax-deferred until withdrawal. Here are some tips for maximizing your RRSP contributions:

- Contribute Early: Contributing to your RRSP early in the year allows your investments to grow tax-deferred for a longer period, maximizing your savings. The earlier you contribute, the more time your investments have to grow.

- Take Advantage of Contribution Limits: The annual contribution limit for RRSPs is based on your earned income and is subject to a maximum limit set by the CRA. Ensure that you take full advantage of your contribution room each year to maximize your tax savings.

- Utilize Unused Contribution Room: If you have unused RRSP contribution room from previous years, consider making additional contributions to catch up. This allows you to maximize your tax deductions and boost your retirement savings.

- Consider Spousal RRSPs: Contributing to a spousal RRSP can provide additional tax savings, especially if there is a significant income disparity between spouses. This strategy allows you to split income in retirement, reducing your overall tax liability.

- Diversify Investments: Diversify your RRSP investments to reduce risk and maximize returns. Consider a mix of asset classes, such as stocks, bonds, and mutual funds, to achieve a balanced and diversified portfolio.

- Plan for Withdrawals: Develop a strategy for RRSP withdrawals in retirement to minimize tax liability. Consider factors such as your retirement income needs, tax brackets, and other sources of income. Proper planning can help you optimize your withdrawals and minimize taxes.

Professional tax advisors, such as BOMCAS, can provide valuable assistance in maximizing your RRSP contributions and developing a comprehensive retirement plan. Our team can help you understand the benefits and limitations of RRSPs, develop a contribution strategy, and ensure that you achieve your retirement goals.

Utilizing Tax-Free Savings Accounts (TFSAs)

Tax-Free Savings Accounts (TFSAs) are another popular retirement savings option in Canada. Contributions to a TFSA are not tax-deductible, but the investment income earned within the account is tax-free. Here are some tips for utilizing TFSAs for retirement planning:

- Contribute Regularly: Regular contributions to a TFSA can help you build significant savings over time. Consider setting up automatic contributions to ensure that you consistently contribute to your TFSA.

- Take Advantage of Contribution Limits: The annual contribution limit for TFSAs is set by the CRA and accumulates each year if unused. Ensure that you take full advantage of your contribution room to maximize your tax-free savings.

- Utilize Withdrawals: Withdrawals from a TFSA are tax-free and can be re-contributed in future years. This flexibility makes TFSAs an attractive option for short-term and long-term savings goals.

- Diversify Investments: Diversify your TFSA investments to reduce risk and maximize returns. Consider a mix of asset classes, such as stocks, bonds, and mutual funds, to achieve a balanced and diversified portfolio.

- Plan for Retirement: Incorporate TFSAs into your overall retirement plan to take advantage of tax-free growth and withdrawals. Consider how TFSAs complement other retirement savings options, such as RRSPs, to achieve a comprehensive and tax-efficient retirement strategy.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in utilizing TFSAs for retirement planning. Our team can help you understand the benefits and limitations of TFSAs, develop a contribution strategy, and ensure that you achieve your retirement goals.

Pension Income Splitting

Pension income splitting is a tax strategy that allows spouses to split eligible pension income, reducing their overall tax liability. Here are some tips for utilizing pension income splitting:

- Understand Eligibility: Eligible pension income includes income from registered pension plans, RRSP annuities, and certain other sources. Ensure that you understand which types of income qualify for pension income splitting.

- Determine the Benefits: Calculate the potential tax savings from pension income splitting. By transferring a portion of your pension income to your spouse, you can take advantage of lower tax brackets and reduce your overall tax liability.

- File the Election: To split pension income, both spouses must file a joint election on their tax returns using Form T1032. Ensure that you complete and file this form accurately to take advantage of the benefits.

- Plan for Retirement: Incorporate pension income splitting into your overall retirement plan to achieve tax-efficient income in retirement. Consider how this strategy complements other retirement savings options and tax planning strategies.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in utilizing pension income splitting. Our team can help you understand the benefits and limitations of this strategy, calculate potential tax savings, and ensure that you achieve your retirement goals.

- Review Regularly: Regularly review your retirement plan and pension income splitting strategy to ensure that it remains effective and aligned with your financial goals. Consider changes in your financial situation, tax laws, and retirement needs.

By incorporating pension income splitting into your retirement plan, Sherwood Park residents can achieve tax-efficient income in retirement and maximize their financial savings. Professional tax advisors, such as BOMCAS, can provide valuable assistance in developing and implementing a comprehensive retirement plan.

Estate Planning and Tax Implications

Estate planning involves organizing your financial affairs to ensure that your assets are distributed according to your wishes after your death. Proper estate planning also involves understanding the tax implications of transferring assets and developing strategies to minimize taxes. Here are some tips for effective estate planning:

- Create a Will: A will is a legal document that outlines how your assets will be distributed after your death. Ensure that you create a will and update it regularly to reflect changes in your financial situation and wishes.

- Consider Tax Implications: Understand the tax implications of transferring assets to your heirs. This includes potential capital gains taxes, probate fees, and other taxes. Develop strategies to minimize these taxes and ensure that your heirs receive the maximum benefit.

- Utilize Trusts: Trusts can be an effective estate planning tool for minimizing taxes and ensuring the efficient transfer of assets. Consider setting up trusts to manage and distribute your assets according to your wishes.

- Plan for Retirement Accounts: Understand the tax implications of transferring retirement accounts, such as RRSPs and TFSAs, to your heirs. Develop strategies to minimize taxes and ensure that your retirement savings are transferred efficiently.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in estate planning. Our team can help you understand the tax implications of transferring assets, develop strategies to minimize taxes, and ensure that your estate plan reflects your wishes.

- Review Regularly: Regularly review and update your estate plan to ensure that it remains effective and aligned with your financial goals. Consider changes in your financial situation, tax laws, and family circumstances.

By incorporating estate planning into your overall financial plan, Sherwood Park residents can ensure that their assets are distributed according to their wishes and minimize the tax burden on their heirs. Professional tax advisors, such as BOMCAS, can provide valuable assistance in developing and implementing a comprehensive estate plan.

Navigating Tax Implications of Life Changes

Marriage and Divorce

Life changes such as marriage and divorce can have significant tax implications. Here are some tips for navigating the tax implications of marriage and divorce:

- Update Your Information: Ensure that you update your marital status with the CRA and other relevant authorities. This includes updating your tax return, benefits, and other financial records.

- Understand Joint and Separate Filing: Understand the tax implications of filing jointly or separately with your spouse. Consider how joint or separate filing affects your tax liability, deductions, and credits.

- Consider Income Splitting: Consider income splitting strategies, such as pension income splitting, to reduce your overall tax liability. By transferring income to your spouse, you can take advantage of lower tax brackets and maximize your tax savings.

- Review Beneficiaries: Review and update the beneficiaries on your financial accounts, insurance policies, and retirement accounts. Ensure that your beneficiaries reflect your current wishes and financial situation.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in navigating the tax implications of marriage and divorce. Our team can help you understand the tax implications, develop strategies to minimize taxes, and ensure that your financial plan reflects your current situation.

- Plan for Future Changes: Consider how future life changes, such as having children or changing employment, may impact your tax situation. Plan ahead to ensure that you are prepared for these changes and can make informed decisions.

Birth of a Child

The birth of a child can have significant tax implications, including eligibility for various benefits and credits. Here are some tips for navigating the tax implications of the birth of a child:

- Register Your Child: Ensure that you register your child with the relevant authorities, including obtaining a Social Insurance Number (SIN) and registering for benefits such as the Canada Child Benefit (CCB).

- Claim Child Benefits: Take advantage of child benefits and credits, such as the CCB, the Universal Child Care Benefit (UCCB), and the Child Disability Benefit (CDB). These benefits provide financial support to help with the cost of raising children.

- Consider Childcare Expenses: Understand the tax implications of childcare expenses, including eligibility for the Childcare Expense Deduction. Keep detailed records of childcare expenses to support your deduction claims.

- Review Education Savings Options: Consider education savings options, such as Registered Education Savings Plans (RESPs), to save for your child’s future education expenses. Contributions to RESPs can provide significant tax benefits and government grants.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in navigating the tax implications of the birth of a child. Our team can help you understand the benefits and credits available, develop a savings plan, and ensure that your financial plan reflects your new situation.

- Plan for Future Changes: Consider how future life changes, such as additional children or changes in employment, may impact your tax situation. Plan ahead to ensure that you are prepared for these changes and can make informed decisions.

Change in Employment

A change in employment can have significant tax implications, including changes in income, deductions, and credits. Here are some tips for navigating the tax implications of a change in employment:

- Update Your Information: Ensure that you update your employment status with the CRA and other relevant authorities. This includes updating your tax return, benefits, and other financial records.

- Understand Employment Expenses: Understand the tax implications of employment expenses, including eligibility for deductions such as travel, tools, and supplies. Keep detailed records of employment expenses to support your deduction claims.

- Consider Retirement Savings: Consider how a change in employment may impact your retirement savings options, such as contributions to RRSPs and TFSAs. Develop a strategy to maximize your retirement savings and minimize your tax liability.

- Review Benefits and Credits: Review your eligibility for benefits and credits, such as the Working Income Tax Benefit (WITB) and the Canada Employment Credit. Ensure that you take advantage of all available benefits and credits.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in navigating the tax implications of a change in employment. Our team can help you understand the tax implications, develop strategies to minimize taxes, and ensure that your financial plan reflects your new situation.

- Plan for Future Changes: Consider how future life changes, such as additional education or changes in family circumstances, may impact your tax situation. Plan ahead to ensure that you are prepared for these changes and can make informed decisions.

Retirement

Retirement is a significant life change that can have substantial tax implications. Here are some tips for navigating the tax implications of retirement:

- Plan for Retirement Income: Develop a strategy for managing your retirement income, including withdrawals from RRSPs, TFSAs, and other retirement accounts. Consider how different sources of income, such as pensions, investments, and government benefits, will impact your tax liability.

- Understand Tax Implications: Understand the tax implications of different retirement savings options and withdrawal strategies. This includes the tax treatment of RRSP withdrawals, TFSA withdrawals, and pension income.

- Consider Income Splitting: Consider income splitting strategies, such as pension income splitting, to reduce your overall tax liability. By transferring income to your spouse, you can take advantage of lower tax brackets and maximize your tax savings.

- Review Benefits and Credits: Review your eligibility for benefits and credits, such as the Age Credit and the Pension Income Credit. Ensure that you take advantage of all available benefits and credits.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in navigating the tax implications of retirement. Our team can help you develop a comprehensive retirement plan, understand the tax implications, and ensure that you achieve your retirement goals.

- Plan for Future Changes: Consider how future life changes, such as changes in health or family circumstances, may impact your tax situation. Plan ahead to ensure that you are prepared for these changes and can make informed decisions.

Death of a Family Member

The death of a family member can have significant tax implications, including the transfer of assets and the settlement of the estate. Here are some tips for navigating the tax implications of the death of a family member:

- Understand the Tax Implications: Understand the tax implications of transferring assets, including potential capital gains taxes and probate fees. Develop strategies to minimize these taxes and ensure the efficient transfer of assets.

- File the Final Tax Return: Ensure that the final tax return for the deceased is filed accurately and on time. This includes reporting all income, deductions, and credits up to the date of death.

- Settle the Estate: Work with the executor of the estate to settle the estate and distribute assets according to the will. Ensure that all tax obligations are met and that the estate is settled efficiently.

- Consider Trusts: Consider setting up trusts to manage and distribute assets according to the wishes of the deceased. Trusts can be an effective estate planning tool for minimizing taxes and ensuring the efficient transfer of assets.

- Seek Professional Advice: Professional tax advisors, such as BOMCAS, can provide valuable assistance in navigating the tax implications of the death of a family member. Our team can help you understand the tax implications, develop strategies to minimize taxes, and ensure that the estate is settled efficiently.

- Plan for Future Changes: Consider how the death of a family member may impact your financial situation and tax obligations. Plan ahead to ensure that you are prepared for these changes and can make informed decisions.

By navigating the tax implications of life changes effectively, Sherwood Park residents can achieve greater financial stability and peace of mind. Professional tax advisors, such as BOMCAS, can provide valuable assistance in understanding the tax implications, developing strategies to minimize taxes, and ensuring that your financial plan reflects your current situation.

Conclusion

Tax planning and preparation are essential components of financial management for Sherwood Park residents. Proper tax planning can help you minimize your tax liability, ensure compliance with tax laws, and achieve your financial goals. By understanding the various components of the tax system, maximizing deductions and credits, and developing strategic tax planning strategies, you can optimize your financial outcomes and enjoy greater peace of mind.

Professional tax advisors, such as BOMCAS, can provide valuable assistance in tax planning and preparation. Our team of experts is dedicated to providing personalized services, ensuring that you receive the guidance and support you need to navigate the complexities of the tax system. Contact BOMCAS today to learn more about our tax planning and preparation services and how we can assist you in achieving your financial goals.